Is your coffee habit really worth it?

Maybe it’s not coffee. We all have little pleasures and people telling us what we should or should not be doing. You know what I’m talking about. Personal finance experts whose entire strategy is to get you to give up some habit and turn it into a retirement fund.

Then there’s the people who say don’t worry about those little habits, focus on the big wins. Maximize your earnings potential, and enjoy your coffee.

So who is right?

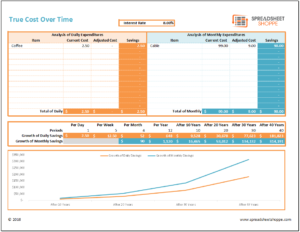

This True Cost Over Time template will help put some context to the arguments above. Find out what makes the most sense for you.

True Cost Over Time Template

System Requirements & General

True Cost Over Time Download

Download 30.58 KB 2484 downloadsOkay, So Who’s Right?

The answer here depends on you. Your personality. The fact is both sides are right. There are two ways to maximize your finances. Manage your expenses and earn more money. Why would a solid plan not include elements of both?

Little things add up. They can be very impactful. This is why there are people who argue that your whole retirement savings can be changing your coffee habit. Those dollars will grow. It’s a matter of significance to you. How much will those dollars grow into and does that number matter to you?

On the flip side, if you can increase the amount of money you make, that can be huge. Getting a raise, changing jobs, or having a side business are all excellent ways to improve your financial position. These are big wins.

From my perspective, both the little wins and the big wins require effort. You need a plan, you should have some type of process to keep you on track. This could be a personal budget or business goal that will help you stay on track. Without a process, the benefits you realize will be far less.

It is easier to understand the impact of the big wins. If you get a $5,000 or $10,000 raise, Bam! You can wrap your mind around that! But, when you start talking about saving $2 or $3 every day…so what? How do you begin to understand what the impact of that is?

This is where the True Cost Over Time template comes in. It will help you calculate the growth of $3 dollars invested every day. Then you can decide for yourself if managing certain small expenses is worth it.

How To Use The Template

First, download the free template above.

The template is broken up into two sections. Daily Expenditures (orange) and Monthly Expenditures (aqua). Within each section enter a description of the item, the current cost and adjusted cost. So if you drink a $3 cup of coffee every day, the $3 is the current cost. If you’re going to start drinking the free coffee they have at work instead then your adjusted cost is $0.

The monthly side works the same way. You’re just thinking about those monthly expenses you have. In the example included in the template we’ve used cable. Let’s say you’re currently spending $99 a month (current cost). However, you’re going to move over to Netflix for $9 a month (adjusted cost). You would be saving $90 each month.

You can include just one item in this template, or multiple. Each time you add an item, you can see what the impact of each item it to the total. The daily and monthly items are summarized individually.

At the very top of the template is an Interest Rate box. Enter the rate of return you expect to get on your savings. The larger the rate, the more growth you’ll see in your savings over time. Be sure this is a reasonable rate of return. If your return is too low or too high, the results will not be accurate.

Last Words

Use the True Cost Over Time template to see the growth of savings over time. Then you can decide if making a change in your spending habits is worth it. Keep in mind that this concept only works if you’re deliberate in what you do with the savings.

If you just stop drinking your $3 coffee each day, but you don’t do anything with that money you’re going to miss the opportunity.

Where this tool can be really fun is use in combination with updating your personal budget and going through your service provider analysis. After going through your budget, you should be able to pick out a few ways you could be managing your expenses better. List those in the True Cost Over Time template. Then in our Service Provider Analysis, we show you how the typical person can recover $1,200 per year. That’s $100 each month! Log those here as well.

If you do this, I would expect you to find the combination of these numbers to be surprising. If you do this, let me know. Was it surprising or not? What were your results?